Yes, you can lease a used SUV—especially through certified pre-owned (CPO) programs offered by dealerships. These leases often come with lower monthly payments, warranty coverage, and flexible terms, making them a smart alternative to buying new or financing a used vehicle.

Key Takeaways

- Leasing a used SUV is possible: Many dealerships and automakers offer lease programs for certified pre-owned (CPO) SUVs, giving you access to late-model, low-mileage vehicles.

- Lower monthly payments: Used SUV leases typically cost less per month than new car leases because the vehicle has already experienced the steepest depreciation.

- Warranty and inspection included: CPO SUVs undergo rigorous inspections and often come with extended warranties, roadside assistance, and maintenance plans.

- Flexible lease terms: You can often find 24- to 36-month lease options on used SUVs, with mileage limits and wear-and-tear guidelines similar to new leases.

- Credit and eligibility matter: While leasing a used SUV may be easier than financing, you’ll still need good credit and meet the lessor’s financial requirements.

- Not all used SUVs qualify: Only vehicles that meet specific age, mileage, and condition standards are eligible for leasing, usually through manufacturer-backed CPO programs.

- Compare total cost of ownership: While monthly payments are lower, consider fees, residual value, and potential maintenance to ensure leasing a used SUV fits your budget long-term.

📑 Table of Contents

Can You Lease a Used SUV? The Surprising Answer

You’ve probably heard that leasing is usually reserved for brand-new cars—those shiny SUVs fresh off the assembly line with zero miles and that new-car smell. But what if you’re looking for something more affordable, more practical, or just don’t want to pay top dollar for a vehicle that loses 20% of its value the moment you drive it off the lot? That’s where leasing a used SUV comes into play.

The short answer? Yes, you can lease a used SUV—especially if it’s part of a certified pre-owned (CPO) program. While it’s not as common as leasing a new vehicle, many dealerships and automakers now offer lease options on late-model, low-mileage SUVs that have been thoroughly inspected and reconditioned. These programs are designed to give buyers the best of both worlds: the lower cost of a used vehicle with the peace of mind and flexibility of a lease.

So why hasn’t leasing a used SUV become mainstream? Part of it comes down to perception. Many people assume that leasing is only for new cars, or that used vehicles are too risky to lease. But as the used car market has evolved—especially with the rise of CPO programs—dealerships have realized there’s real demand for affordable, reliable, short-term vehicle options. And leasing a used SUV fits that need perfectly.

How Leasing a Used SUV Works

Visual guide about Can You Lease a Used Suv

Image source: leaseenddepartment.com

Leasing a used SUV isn’t all that different from leasing a new one—just with a few key adjustments. Instead of driving a brand-new model, you’re getting a vehicle that’s typically 1 to 3 years old, with low mileage (usually under 45,000 miles), and in excellent condition. These SUVs are often former lease returns, rental cars, or trade-ins that have been inspected, repaired if necessary, and certified by the manufacturer or dealership.

Certified Pre-Owned (CPO) Programs Are Key

The backbone of leasing a used SUV is the CPO program. These programs are offered by nearly every major automaker—Toyota, Honda, Ford, BMW, Mercedes-Benz, and more—and they set strict standards for vehicle eligibility. To qualify, a used SUV must pass a multi-point inspection (often 150+ points), have a clean title, and meet age and mileage limits. Once certified, the vehicle comes with an extended warranty, often covering powertrain components for several years or miles.

For example, a 2022 Toyota RAV4 with 28,000 miles might be available for lease through Toyota’s CPO program. It’s not new, but it’s nearly so—and it comes with a 12-month/12,000-mile comprehensive warranty, plus the remainder of the original 3-year/36,000-mile basic warranty. That kind of coverage makes leasing a used SUV feel almost as safe as leasing a new one.

Lease Terms and Structure

Lease terms for used SUVs are typically shorter than those for new vehicles. While new car leases often run 36 to 48 months, used SUV leases are commonly 24 or 36 months. This makes sense—since the vehicle has already depreciated significantly, the lessor wants to recoup value quickly and avoid holding onto an older asset too long.

Monthly payments are generally lower than new leases because the capitalized cost (the amount being financed) is lower. For instance, leasing a new 2024 Honda CR-V might cost $450 per month, while leasing a 2022 CPO CR-V with 30,000 miles could drop that payment to $320–$350. That’s a savings of over $100 per month—or more than $3,600 over a three-year lease.

Mileage limits and wear-and-tear guidelines are similar to new leases. Most used SUV leases allow 10,000 to 15,000 miles per year, and you’ll be charged per mile if you exceed that. Excessive wear—like deep scratches, dents, or interior damage—can also result in fees at the end of the lease.

Who Offers Used SUV Leases?

Not every dealership or leasing company offers used SUV leases, but many do—especially those affiliated with major brands. Here are a few examples:

– **Toyota**: Offers CPO lease programs on eligible RAV4, Highlander, and 4Runner models.

– **Honda**: Leases certified pre-owned CR-V, Pilot, and HR-V SUVs with warranty protection.

– **Ford**: Provides lease options on CPO Ford Explorer, Escape, and Edge models.

– **BMW and Mercedes-Benz**: Luxury brands often lease late-model CPO SUVs like the X3, X5, GLC, and GLE with premium features and extended coverage.

Some independent leasing companies and online platforms are also beginning to offer used vehicle leases, though these are less common and may come with higher interest rates or stricter terms.

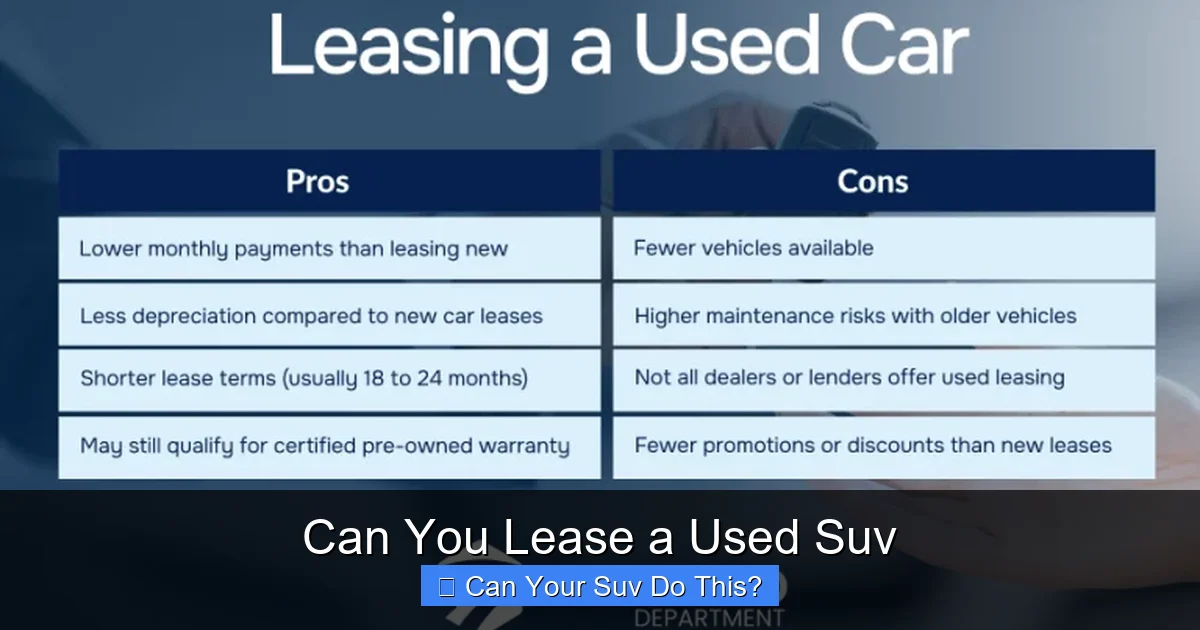

Benefits of Leasing a Used SUV

Leasing a used SUV isn’t just a budget-friendly alternative—it’s a smart financial move for many drivers. Here’s why more people are choosing this path.

Lower Monthly Payments

The biggest advantage is cost. Because the SUV has already taken the biggest hit in depreciation, the monthly lease payment is significantly lower than it would be for a new model. This frees up cash for other expenses—like insurance, fuel, or even saving for a future purchase.

For example, leasing a new 2024 Subaru Outback might cost $480 per month. But leasing a 2022 CPO Outback with 25,000 miles could bring that down to $340. Over three years, that’s a savings of $5,040—enough to cover a year of car insurance or a nice vacation.

Reduced Depreciation Risk

New cars lose value fast. In the first year alone, a new SUV can lose 20% or more of its value. By leasing a used SUV, you’re avoiding that steep depreciation curve. The previous owner absorbed the biggest drop in value, so you’re only paying for the vehicle’s use during your lease term—not its rapid decline in worth.

Warranty and Peace of Mind

One concern about used vehicles is reliability. But CPO SUVs come with strong warranties that often surpass what you’d get with a new car lease. Many programs include roadside assistance, rental car reimbursement, and complimentary maintenance for the first year.

For instance, Hyundai’s CPO program offers a 10-year/100,000-mile powertrain warranty and a 1-year/12,000-mile comprehensive warranty. That’s longer than the standard new car warranty on many models. So even though the SUV is used, you’re protected against major repairs.

Flexibility and Lower Commitment

Leasing a used SUV gives you flexibility. You’re not tied to a long-term loan or ownership. At the end of the lease, you can walk away, upgrade to a newer model, or even buy the vehicle if you love it. This is ideal for people who like to change cars every few years or aren’t ready to commit to ownership.

It’s also great for those who need an SUV temporarily—say, for a growing family, a cross-country move, or a job that requires extra space. Instead of buying and selling later, you lease for 2–3 years and return the keys when you’re done.

Access to Higher-End Models

Because used SUVs are cheaper to lease, you might be able to afford a higher trim level or a more luxurious model than you could with a new car lease. For example, leasing a used BMW X5 with premium features might cost less per month than leasing a new Toyota RAV4 base model.

This allows you to enjoy luxury, performance, and advanced tech without the steep price tag of a new luxury SUV.

Potential Drawbacks and Considerations

While leasing a used SUV has many benefits, it’s not the right choice for everyone. Here are some factors to consider before signing a lease agreement.

Availability Is Limited

Not every used SUV can be leased. Only vehicles that meet strict CPO criteria are eligible, which means your options may be narrower than if you were buying used. You might not find the exact model, color, or trim you want in a lease-ready condition.

Additionally, popular SUVs like the Honda CR-V or Toyota RAV4 may have high demand in the CPO lease market, leading to limited inventory or higher prices.

Higher Interest Rates (Money Factor)

Used vehicle leases often come with a higher money factor (the leasing equivalent of an interest rate) than new car leases. This is because lenders see used vehicles as slightly riskier assets. While the monthly payment may still be lower overall, the cost of borrowing could be higher.

For example, a new SUV lease might have a money factor of 0.00150 (equivalent to 3.6% APR), while a used SUV lease could be 0.00200 (4.8% APR). Always ask for the money factor and compare it across offers.

Wear and Tear Fees Still Apply

Just like with a new lease, you’re responsible for excessive wear and tear on a used SUV. Even though the vehicle isn’t new, the lessor will inspect it at the end of the lease and charge for damage beyond “normal use.” Scratches, dents, stained upholstery, or mechanical issues not covered by warranty could result in fees.

To avoid surprises, take detailed photos before you drive off the lot and review the lease agreement’s wear-and-tear guidelines.

No Equity Build-Up

Leasing—whether new or used—doesn’t build equity. You’re paying to use the vehicle, not own it. At the end of the lease, you return the SUV and walk away (unless you choose to buy it). If you’re looking to build long-term value or eventually own a vehicle, buying might be a better option.

However, if your goal is low monthly payments and flexibility, the lack of equity isn’t a dealbreaker.

Early Termination Penalties

Ending a lease early can be expensive. Most lease contracts include penalties for early termination, which can cost thousands of dollars. If you think your needs might change—like moving, changing jobs, or needing a different type of vehicle—make sure you understand the terms before signing.

Some leases offer early termination options or lease transfer programs, but these are not guaranteed.

How to Find and Lease a Used SUV

Ready to explore leasing a used SUV? Here’s a step-by-step guide to help you find the right vehicle and secure a great deal.

1. Research CPO Programs

Start by visiting the websites of automakers you’re interested in. Look for their certified pre-owned sections and filter for SUVs that are eligible for lease. Most brands allow you to search by model, year, mileage, and location.

For example, on the Ford website, you can search for CPO Ford Explorers and see which ones are available for lease in your area. You’ll get details on pricing, warranty, and lease terms.

2. Compare Lease Offers

Don’t settle for the first offer you see. Compare lease deals from multiple dealerships and brands. Look at:

– Monthly payment

– Down payment (cap cost reduction)

– Lease term

– Mileage allowance

– Money factor (interest rate)

– Warranty coverage

Use online lease calculators to estimate payments and see how different terms affect your budget.

3. Check Your Credit

Your credit score will impact your lease approval and money factor. Aim for a score of 680 or higher to qualify for the best rates. If your credit is lower, you may still get approved, but expect higher payments or a larger down payment.

Consider getting pre-approved for a lease through your bank or credit union to compare offers.

4. Inspect the Vehicle

Even though CPO SUVs are inspected, it’s smart to do your own walk-around. Check for:

– Paint condition and body damage

– Tire tread and alignment

– Interior cleanliness and wear

– Functioning electronics (infotainment, climate control, lights)

– Test drive for unusual noises or handling issues

Ask for the vehicle history report (like Carfax or AutoCheck) to confirm no accidents or major repairs.

5. Negotiate the Terms

Leasing a used SUV is negotiable—just like buying. You can often lower the capitalized cost (the price being financed) by negotiating the selling price of the vehicle. Even small reductions can lead to big savings over the lease term.

You can also ask for:

– Lower money factor

– Waived acquisition fee

– Higher mileage allowance

– Free maintenance or roadside assistance

Don’t be afraid to walk away if the deal isn’t right.

6. Read the Fine Print

Before signing, read the entire lease agreement. Pay attention to:

– Early termination fees

– Excess mileage charges

– Wear-and-tear guidelines

– Disposition fee (charged when you return the vehicle)

– Option to purchase at lease end

Make sure everything matches what was discussed and that there are no hidden fees.

Is Leasing a Used SUV Right for You?

Leasing a used SUV is a smart choice for many drivers, but it depends on your lifestyle, budget, and goals.

It’s ideal if you:

– Want lower monthly payments than a new car lease

– Prefer driving a different vehicle every few years

– Need an SUV temporarily (for family, work, or travel)

– Want warranty protection without buying new

– Have good credit and stable income

It may not be the best fit if you:

– Drive more than 15,000 miles per year

– Plan to keep the vehicle long-term

– Want to customize or modify the SUV

– Prefer building equity in a vehicle

Ultimately, leasing a used SUV offers a balanced approach—affordability, reliability, and flexibility—without the high cost of new car ownership.

Final Thoughts: Yes, You Can—and Should Consider It

The idea of leasing a used SUV might have seemed unconventional a decade ago, but today it’s a practical, cost-effective option for savvy drivers. With certified pre-owned programs, strong warranties, and lower monthly payments, you can enjoy the benefits of a late-model SUV without the steep price tag of a new lease.

Whether you’re looking for a fuel-efficient compact SUV like the Mazda CX-5, a rugged off-roader like the Jeep Grand Cherokee, or a luxury ride like the Lexus RX, there’s likely a used model available for lease. And with the right research and negotiation, you can drive away with a great deal and peace of mind.

So next time you’re in the market for an SUV, don’t overlook the used lease option. It might just be the smartest move you make.

Frequently Asked Questions

Can you lease a used SUV from any dealership?

Not all dealerships offer used SUV leases. You’ll typically need to go through a certified pre-owned (CPO) program at a franchised dealership affiliated with the vehicle’s brand. Independent dealers rarely offer lease options on used vehicles.

Are used SUV leases cheaper than new ones?

Yes, used SUV leases generally have lower monthly payments because the vehicle has already depreciated. However, the money factor (interest rate) may be slightly higher, so compare total costs before deciding.

Do I need good credit to lease a used SUV?

Yes, most lessors require a credit score of 680 or higher for the best terms. Lower scores may still qualify but could result in higher payments or a larger down payment.

Can I buy the SUV at the end of the lease?

Yes, most used SUV leases include a purchase option. At the end of the lease, you can buy the vehicle at its residual value, which is set at the beginning of the lease.

What happens if I go over the mileage limit?

You’ll be charged a per-mile fee, typically $0.10 to $0.25, for every mile over your annual limit. To avoid fees, choose a mileage allowance that matches your driving habits.

Are maintenance and repairs covered during the lease?

Basic maintenance may be included in some CPO programs, but major repairs are usually covered by the warranty. Always check what’s included in your specific lease agreement.